Your Council Tax bill is made up of four key sections:

The top of the bill shows your address and Council Tax account number.

- You will need this number when contacting us either by telephone, email or through our my account system (as well as the online keycode shown further down the bill, see below).

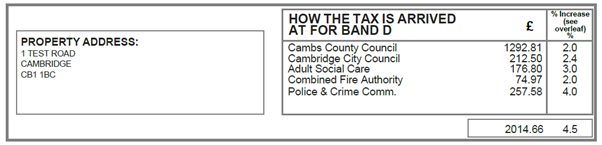

The next section shows:

- the band given to your property

- and the breakdown of the total cost of Council Tax for the year

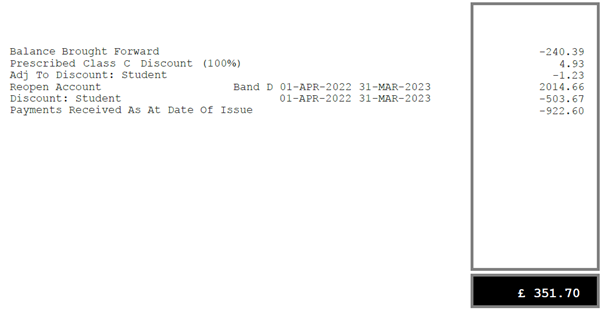

The next section shows:

- Figure 1: the total cost of Council Tax charged for the year, before any discount is applied.

- Figure 2: If you are claiming a discount, it is listed here and shows how much discount is applied.

- Figure 3: Shows the total amount that is outstanding, at the time the bill was created (usually in April).

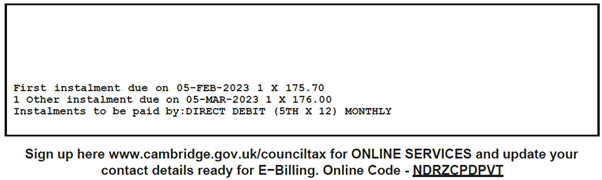

The last part of the bill shows:

- Figure 1: The instalment plan you have agreed to pay, if you pay by direct debit

- Figure 2: Your unique online key code to access your account in our my account system. Note this changes every time we send you a new bill, so you need to use the latest bill when accessing your account.