We are responsible for collecting Council Tax from Cambridge residents to help pay for the work of local councils and the emergency services.

Council Tax is a property-based tax which is payable on most domestic properties, and what you pay is divided between the county council, the police and crime commissioner, the combined authority, the fire authority and the city council.

There is one Council Tax bill per property, whether it is owned or rented, and the people who live there would normally be responsible for paying it.

We will spend approximately £113.4m in 2025/26 delivering services in Cambridge.

Our budget for 2025/26 puts us on track to meet our target of saving £6 million a year by April 2026, to keep the council financially sustainable while investing in key priorities: building new council homes, supporting community initiatives, and tackling climate change.

While we currently have healthy reserves or ‘savings’ of around £20 million, if no action was taken to balance the budget, these reserves would run out by 2029/30 as they would have to be drawn on to cover an annual deficit, rather than investing in projects that bring long term benefits.

We have prioritised finding efficiencies in service delivery, and increased some charges, to protect essential frontline and safety net services for our most vulnerable residents.

In addition, some core areas of work will continue to be prioritised in line with public support. This includes:

- running community centres

- continued funding of redeployable CCTV cameras and a one-off investment of £120,000 to upgrade our CCTV control rooms

- delivering equalities and cohesion work – such as providing funding to help support the Pink Festival Group charity to run their annual Cambridge Pride event

- supporting residents to stay healthy and well with subsidies for activities for those who need it most

- supporting and delivering the ongoing arts and cultural development programme – including improvements at the Corn Exchange, running the annual free fireworks event, and a one-off programme of free folk events in 2025

Council Tax is divided between the county council, the police and crime commissioner, the fire authority and the city council. In 2025/26 our share is 9.86%.

| Authority | 2024/25 amount | 2024/25 share | 2025/26 amount | 2025/26 share |

|---|---|---|---|---|

| County council | £1,619.82 | 72.03% | £1,700.64 | 72.2% |

| Police and crime commissioner | £285.48 | 12.69% | £299.43 | 12.71% |

| City council | £225.39 | 10.02% | £232.13 | 9.86% |

| Fire authority | £82.26 | 3.66% | £87.21 | 3.7% |

| Cambridgeshire and Peterborough Combined Authority | £36 | 1.6% | £36 | 1.53% |

| Total | £2,248.95 | 100% | £2,355.41 | 100% |

A household living in a Band D property in Cambridge will pay £2,355.41 in Council Tax from April 2025, of which we will retain £232.13.

All changes have been set in accordance with the Referendums Relating to Council Tax Increases (Principles) (England) Report 2023/24, which specifies maximum increases by authority.

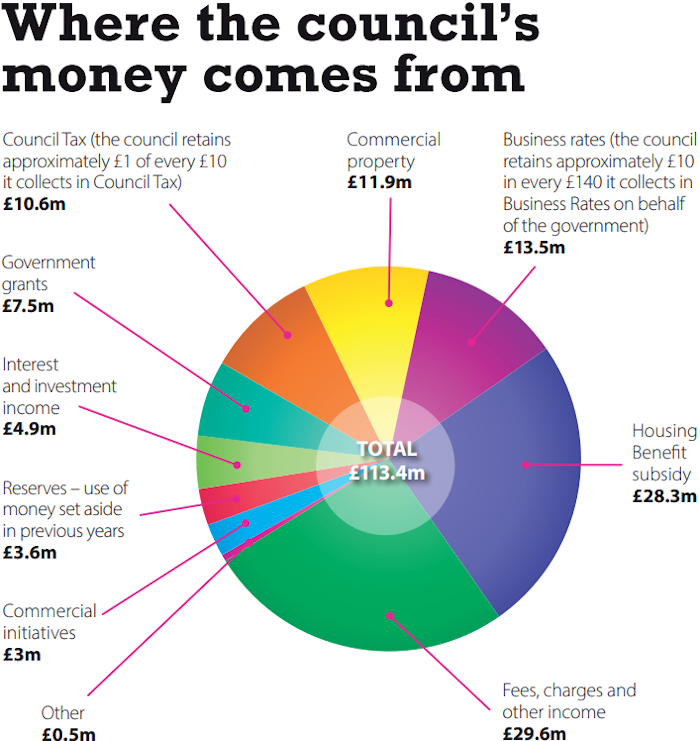

Our income

We will spend approximately £113.4 million on delivering services in Cambridge in 2025/26.

We receive income from fees and charges for services, commercial property rents and Housing Benefit subsidy. Income also comes from your Council Tax payments, grants from the government and a share of local business rates.

We are landlord to more than 7,500 council homes, and the rents from these are kept separately to pay for housing services.

| Service | Income |

|---|---|

| Fees, charges and other income | £29.6m |

| Housing Benefit subsidy | £28.3m |

| Business rates (the council retains approximately £10 in every £140 it collects in Business Rates on behalf of the government) | £13.5m |

| Commercial property | £11.9m |

| Council Tax (the council retains approximately £1 of every £10 it collects in Council Tax) | £10.6m |

| Government grants | £7.5m |

| Interest and investment income | £4.9m |

| Reserves – use of money set aside in previous years | £3.6m |

| Commercial initiatives | £3m |

| Other | £0.5m |

| Total income | £113.4m |

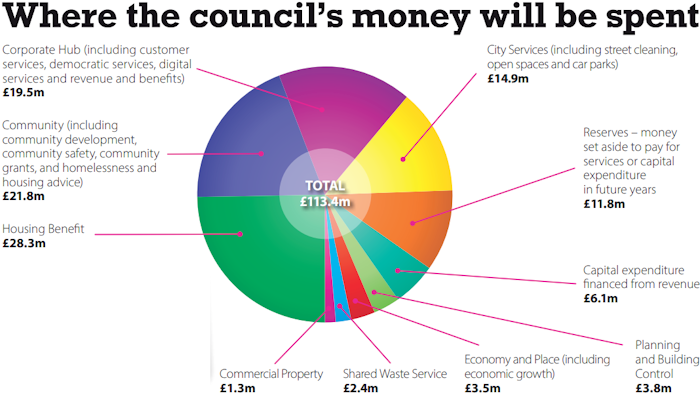

Our expenditure

| Service | Expenditure |

|---|---|

| Housing Benefit | £28.3m |

| Community (including community development, community safety, community grants, and homelessness and housing advice) | £21.8m |

| Corporate Hub (including customer services, democratic services, digital services and revenue and benefits) | £19.5m |

| City Services (including street cleaning, open spaces and car parks) | £14.9m |

| Reserves - money set aside to pay for services in future years | £11.8m |

| Capital expenditure financed from revenue | £6.1m |

| Planning and Building Control | £3.8m |

| Economy and Place (including economic growth) | £3.5m |

| Shared Waste Service | £2.4m |

| Commercial Property | £1.3m |

| Total expenditure | £113.4m |

In 2024/25 your Council Tax helped to pay for a wide range of services for Cambridge residents, including:

- Collecting local taxes and administering housing benefit and support for Council Tax – We collected £102.5m in Council Tax from 60,831 households and £128.8m in business rates from 4287 businesses. We paid around £27m in housing benefit and awarded nearly £9.6m in Council Tax support and made £149,000 of Discretionary Housing Payments.

- Keeping streets and open spaces clean and tidy – We routinely maintained over one million square metres of grass and collected waste from bins in parks and open spaces. We cleared 296 reports of offensive graffiti and 688 reports of detrimental graffiti and removed 1528 incidents of flytipping. We also responded to 294 reports of abandoned vehicles.

- Helping residents to be healthy and active – Over 8,000 participations in Active Lifestyle activities. We were able to offer over 1600 hours of free and low-cost activities to support physical activity and healthy lifestyles. We also offered 129 participation grants to help young people and families access sport and activity

- Providing community centres, community development activities and a community grants programme – During 2024, over 185,000 visits were made to our community. Our community grants programme allocated over £1.14m to voluntary and community groups for projects to reduce social and economic disadvantage for residents with the greatest need.

- Providing leisure facilities including indoor and outdoor swimming pools – During the year there were around 500,000 swims in our swimming pools and nearly 178,000 visits to our sports facilities. Over 58,000 of the visits were made by people with concessionary memberships.

- Dealing with antisocial behaviour and calls about noise nuisance – During 2024 our Antisocial Behaviour team dealt with 839 reports of anti-social behaviour and delivered interventions that reduced risk in 84% of cases.

Since April last year, our Environmental Health Service responded to just over 730 complaints about noise nuisance. - Managing and maintaining over 7,500 council homes – In 2025/26 an estimated £47m will be used to manage and maintain council homes. A further estimated £83m will be used to build new homes and to make improvements to existing homes, such as improving their energy efficiency.

- Providing housing advice and support – During 2024 the council and its partners prevented or relieved homelessness for over 370 households and secured housing in the private rented sector for nearly 160 households in housing need. The council also supported rough sleepers – 26 were identified in Cambridge during the annual count.

- Planning for new developments and growth in the city and determining planning applications – In the year our shared planning service continued to take forward our Local Plan, dealt with over 2,500 applications (including preapplication advice) in the city, determined 89% of major applications and 95% of non-major applications within the original or agreed extension deadlines.

- Managing our car parks and promoting greener travel – Our multi-storey car parks accommodated 1.95m vehicles throughout the year as visitors travelled to the city. We maintained our complimentary Shopmobility service, providing the hire of mobility aids including scooters and wheelchairs to support city centre accessibility. Additionally, we remained committed to sustainable transportation by promoting greener travel options, advocating for car clubs, and expanding our electric vehicle (EV) charging infrastructure. We introduced the country’s first accessible EV charging facility at Park Street car park accredited with the PAS1899 Disability Access award.

- Emptying your bins and improving recycling – Our shared waste service has collected waste from over 52,000 bins in the city, missing just under 0.1% of bin collections in the year from April 2024 to January 2025. We have also diverted just over 50% of household waste from landfill.

- Responding to your enquiries – In 2024, our customer services centre received over 225,000 contacts, including telephone calls, emails and in-person visits from customers to our reception. Almost 92% of customers telephoning in had their query dealt with first time and nearly 150,000 service requests were also made online by Cambridge residents.

Services we provide

Cultural, environmental, regulatory and planning services

- Community, arts and recreation – Providing and managing community centres, neighbourhood community development activity, children and young people’s services, arts and sports development, recreation and swimming facilities and our outdoor event programme. Supporting the Corn Exchange and Cambridge Folk Festival.

- Economic development – Management of commercial properties and the local markets.

- Environmental health and protection – Monitoring and enforcing food hygiene standards. Control of pests, diseases, noise and air pollution. Licensing of taxis, liquor and gambling.

- Planning and development control – Dealing with planning and building control applications. Managing and planning for growth in the city.

- Climate change and sustainability – Working to reduce the council’s own production of CO2 and to reduce the impact of climate change on Cambridge.

- Streets and open spaces – Managing the city’s parks and open spaces, keeping them and the streets clean. Provision and management of play areas, allotments, residential moorings and public toilets.

- Waste management – Collection of household and trade waste and promoting recycling through the shared waste service created with South Cambridgeshire District Council.

- Other services – Including CCTV and the city’s cemeteries and crematorium.

Highways and transport

- Parking services – Provision of off-street car parks.

- Sustainable transport initiatives – Encouraging cycling and walking. Support for public transport, including Taxicard and Dial-a-Ride.

Housing services

- Private sector housing – Encouraging and enabling the private sector to maintain the standard of its properties and promoting energy efficiency.

- Development – Working to enable the provision of new affordable housing.

- Homelessness – Working to prevent homelessness and reduce rough sleeping.

- Other services – Including housing advice, maintaining the housing needs register and providing more choice in social housing, tackling anti-social behaviour and promoting community safety.

Central services to the public

- Elections – Running local and national elections and maintaining the electoral register.

- Local tax collection – Collecting Council Tax for our own services and on behalf of the county council, the fire authority, the police and crime commissioner and national business rates collection.

- Housing Benefit and Council Tax support – Payment of Housing Benefit and Local Housing Allowance and Council Tax support to those on a low income, whether they are working or not. This includes pensioners.